HAPPY BIRTHDAY CHAIRMAN IVES

Rang-ay Bankers celebrated the 68th birthday of Chairman Ives Nisce last October 15, 2021 with the theme “ Blue Jeans and Facemask Party”. The celebration held at the bank’s Conference Hall at 30% capacity with more branch employees participating via Zoom.

The celebration started with an e-Mass at Rang-ay Head Office 4th floor followed by an online roll-call of the branches. The e-Greetings from all the branches and Head Office units were shown. Adding fun to the celebration were the performance of Magsingal Branch and live presentations from Baguio Branch & CMU-RMU Department. Bacnotan Branch was adjudged as Best in e-Greetings while CMU-RMU Department won Best in Presentation.

A major highlight of the event was the recognition of the top performing Clusters, Branch & HO Unit for the 1st Semester of 2021. Dagupan Cluster (Dagupan & Rosales Branches) was awarded as the Top Performing Cluster while Accounting Department & Office of the Area Manager (South) received the President’s Award during the 1st Semester of 2021.

MORE BRANCHES RECEIVE SAFETY SEALS

Rang-ay Bank branches in Sta. Lucia (Ilocos Sur), Dingras (Ilocos Norte), Rosario (La Union) and Aringay (La Union) received their respective Local Government Unit (LGU) Safety Seal Certifications. These branches successfully complied with all the public health standards and contact tracing requirements.

Meanwhile the Head Office and seven (7) more branches of Rang-ay including Main Branch, SF Downtown, SF Highway, Tubao and Bangar in La Union, Bangui (IN) and Magsingal (IS) have already complied with all the requirements and waiting for the release of their safety seal certificates.

The Safety Seal Certification Program is in accordance with Inter-Agency Task Force (IATF) Resolution No. 87-s. 2020, DOLE -DOH-DILG DOT -DTI joint Memorandum Circular No. 21-01s, 2021, which promotes increased compliance of private and public establishments to the minimum public health protocols designed to help stop the covid pandemic in the country and safely open the economy.

RENEWS RANG-AY’S APDS ACCREDITATION

The Department of Education (DepED) approved Rang-ay Bank’s re-accreditation for the Automatic Payroll Deduction Scheme (APDS) under IBM Code No. 300 last September 24, 2021.

The new Memorandum of Agreement (MOA) is effective until 2025, allowing the bank to continue its Salary Loan Program to teaching and non-teaching personnel of public elementary and secondary schools in the Ilocos and Cordillera Regions. The bank has been DepED’s partner since 1990 being one of the first APDS accredited banks in the country.

Regular and permanent public elementary and secondary school teachers and support personnel may apply for a loan in Rang-ay Bank for a maximum loanable amount of P200,000 for regular DepED and P700,000 for Autonomous High School with terms from 1 year to 3 years. For more details about the bank’s DepED Loan Program, visit our website at www.rangaybank.com/services/depedteachersloan. The bank is compliant with all DepED APDS guidelines.

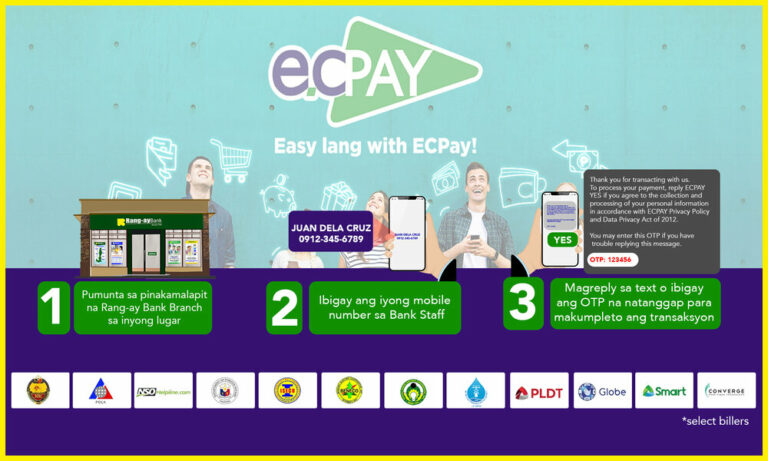

PAY YOUR BILLS AT RANG-AY BANK: Powered By ECPAY

Rang-ay Bank in partnership with ECPay lets you pay your bills in the most convenient, reliable and easiest way. Pay for your electric and water utilities, postpaid mobile phone, loans, insurance, cable and internet thru ECPay at any of the 30 branches of Rang-ay Bank in Region 1 and Cordillera Region.

This process of Bills Payment powered by ECPay also complies with Republic Act No. 10173, otherwise known as Data Privacy Act. This law seeks to protect all forms of information and is meant to cover natural and juridical persons involved in the processing of personal information. With this new update, clients may now use their mobile number in any ECPay transactions as easily as these 3 steps.

RANG-AY PRESIDENT ELECTED NATIONAL DIRECTOR OF RBAP

Rang-ay Bank President & CEO Ives Jesus Nisce II was elected for the 3rd time as National Director representing Region 1 (Ilocos & Cordillera) of the Rural Bankers Association of the Philippines (RBAP) last May 25-27, 2021 via teleconference.

RBAP is the national association of rural banks, founded in 1955 and has since grown into a network of over 400 rural bank members nationwide with a network of more than 3,000 branches/offices, covering some 80% of all the municipalities and cities in the Philippines.