AWARDING OF WINNERS: SALIP TI PANAGSURAT ITI DANIW

Rang-ay Bank awarded the top six (6) winners of the Online Poetry Contest last May 25, 2021 at the Bank’s Conference Room, City of San Fernando, La Union and in the bank branches where the winners reside.

Richie Noveloso of Luna, La Union (1st place), Kayecee Lacar Alejandro of Caba, La Union (2nd), Tricia Mae Cruz of Cabugao, Ilocos Sur (3rd) Claudine Kay C. Flores of Cabugao, Ilocos Sur (4th), Cheryl Del Rosario Galon of Candon, Ilocos Sur (5th) and Michael John Ancheta of Bacarra, Ilocos Norte (6th) received their plaques and certificates plus cash incentives.

Rang-ay Bank also acknowledged the contributions of Ms. Djuna Alcantara and the distinguished panel of Judges: Dr. Edilberto Angco; Mr. Peter La Julian and Mr. Al Gerald Barde for making the contest successful.

Rang-ay Bank President & CEO, Ives Jesus Nisce II congratulated all the winners and encouraged them to continue to instill in the consciousness of the Ilokanos, the legacy of the Iloko language.

COMMUNITY PROJECTS IN ILOCOS AND LA UNION

Rang-ay Bank Narvacan (Ilocos Sur) and Luna (La Union) branches celebrated their anniversaries by conducting community projects in their respective areas last May 12 & 14, 2021.

Narvacan (Ilocos Sur) Branch marked its 12th Anniversary with a donation of 100 long sleeve jerseys to the Narvacan Tricycle Operators & Drivers Association (NATODA) last May 12, 2021. The Rang-ay Team distributed the jerseys to tricycle drivers in terminals of Narvacan. NATODA President, Florence Arcala expressed her thanks to Rang-ay Bank in behalf of drivers and operators who are also frontline transport workers.

To celebrate its 9 years of service, Luna (La Union) Branch donated long-sleeved shirts and sunhats to the Stone Pickers Association of Luna, La Union: Pebble Capital of the North. Pebble picking is one of the primary local industries in Luna. Rang-ay Team turned over the donations to the beneficiaries and conducted a Financial Literacy Training. Brgy. Magallanes Chairwoman Arcely Apilado and the President of Luna Stone Pickers Association Mr. Henry Dinangan thanked Rang-ay Bank for supporting the local cottage industry of Luna and its workers.

Community Projects organized by the bank are properly coordinated with their respective Local Government Units (LGUs). All Covid and safety protocols are followed in each event. The bank enjoins everyone to continue following covid protocols. Stay Safe!

ONLINE 2021 STOCKHOLDERS’ MEETING

Rang-ay Bank held its Annual Stockholders’ Meeting via videoconference last April 25, 2021. The yearly meeting of the bank’s shareholders allows management to report the company’s business operations for fiscal year of 2020 and to elect the Board of Directors.

Despite the pandemic, the bank continued lending to the agricultural sector. 34.7% of the bank’s loanable funds were extended to agricultural projects and farmers. The bank once again accredited as a Rural Financial Institution (RFI) by the Bangko Sentral ng Pilipinas. Likewise, the bank continues to support local businesses by lending to micro, Small and Medium enterprises (mSMEs). In support of its borrowers, the bank implemented the “Bayanihan to Heal as One” (BAHO) Act and “Bayanihan to Recover as One (BARO) Act” providing penalty-free extensions to all qualified borrowers.

2020 also marked the opening of the bank’s 30th Branch in the G/F of Aringay Public Market in San Benito Sur, Aringay, La Union. The year also saw the deployment of five (5) additional ATM units from DBP and EnCash totaling to 10 units. The bank became a full member of the Philippine Electronic Fund Transfer & System Operations Network (PESONET) making bank-to-bank transfers easier and SSS benefits more accessible.

Chairman Nisce acknowledged the bank’s officers and staff for their hard work and dedication to maintain its status as the biggest bank in its class in the Ilocos and Cordillera despite the unforeseen challenges brought about by the pandemic. He also thanked the local communities it serves for their continued trust and support of their local bank.

ATTY. RODOLFO M. NISCE (MAY 23, 1921 – APRIL 30, 1993)

Rang-ay Bank commemorates the 100th birth anniversary of the late Atty. Rodolfo M. Nisce, who was born on May 23, 1921, in Luna, La Union to Don Teofilo Nisce and Rosario Madamba of Dingras, Ilocos Norte. Together with his wife, Eufrosina Querol, and other members of their family, they put up Rang-ay Bank in 1956. Atty. Nisce served as the first President of the bank since it’s establishment in 1956 up to 1976 and then was the Chairman of the Board of Directors from 1977 until he passed away in 1993. He guided the first private bank in La Union to become the biggest in its class in the Ilocos and Cordillera Regions with 30 branches in the six provinces of La Union, Ilocos Sur & Norte, Pangasinan, Abra and Benguet.

Atty. Nisce is a born leader and a very civic-oriented person who helped organize the 1st Rotary Club of La Union and became its president. He was then elected as District Governor of Rotary International, the first Rotarian from Region I to be elected to such position. He was also active in religious and charitable organizations and served as Provincial Board member of the province of La Union from 1980 to 1986.

The bank partnered with the Rotary Club of San Fernando, La Union to set up the Rotary PDG Rudy Nisce Foundation which supports deserving students pursue their college education.

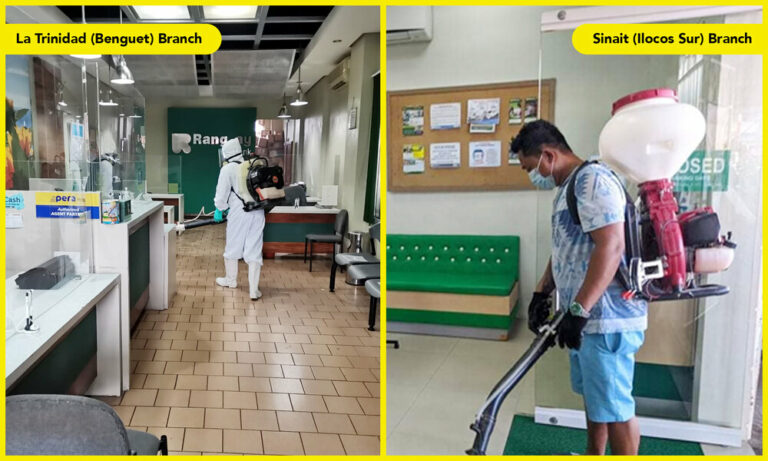

DISINFECTION OF BANK PREMISES

In view of the prevailing threat of Covid-19, Rang-ay Bank in coordination with the Local Government Units (LGUs) and service providers Environet & New Norms, continue to conduct deep disinfection and complete sanitation in all branches of the bank. During the months of April and May 2021 several branches again underwent this procedure.

This is part of the bank’s covid-19 protocols to prevent the virus from spreading and to ensure the safety of our clients as well as bank personnel. Rang-ay Bank strictly follows precautionary health measures, especially inside the bank premises.

We urge the public to wear facemasks and face shields all the time, frequent hand washing & sanitation and observe social distancing. Let us unite to stop covid-19.