DEPOSIT & WITHDRAW KAHIT SAAN

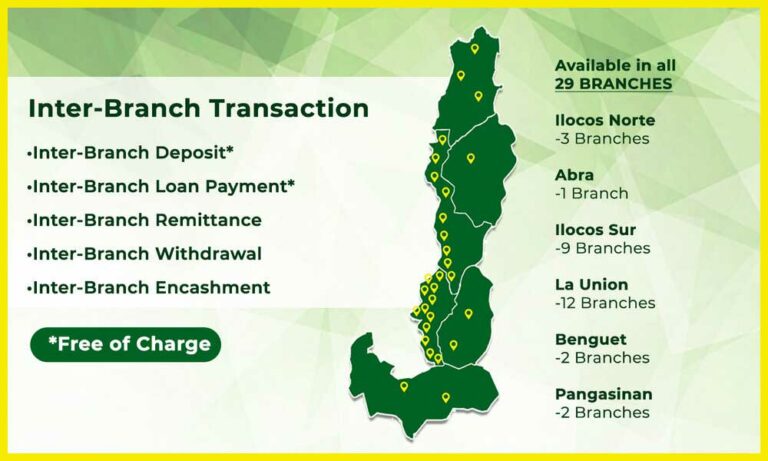

Rang-ay clients continue to reap the benefits of the bank’s new Core Banking System. Inter-Branch Transactions such as Deposits, Loan Payments, Remittances, Withdrawals and Encashments are now easier to use and available in all 29 branches of Rang-ay Bank all over Region I and Cordilleras.

Inter-branch deposit is free of charge with no maximum amount, no maximum number of transactions and can be done by depositors in any Rang-ay Bank Branch. Withdrawals and check encashments through inter-branch can be processed by Account holders in any Rang-ay office for minimal fees. Additionally, inter-office remittance is available to both clients and non-clients as affordable means of transferring money. Visit your nearest Rang-ay Bank Branch for the cheapest remittance service in the Ilocos Region.

For more information about the bank’s list of products and services, visit our website at www.rangaybank.com. You may also course your queries to our facebook page at facebook.com/rangaybank.

NEW REMITTANCE SERVICES

Rang- ay Bank clients now have more choices for remittance services as the bank on boards more remittance partners: Instapay & Pesonet, Transfast and iRemit.

Transfast and iRemit offer reliable remittance service with Rang-ay Bank as a remittance partner to service clients who will be availing of these services. Transfast is an international money transfer and cross border payments company that offers cash payout service with no payout limit. iRemit on the other hand is a Philippine-based company that engages in providing fund transfer and remittance service with a maximum of Php 50,000 payout limit every transaction.

These new remittance services are now available in all 29 branches of Rang-ay Bank. These partnerships are in addition to its existing network with Western Union and BDO Remit.

CONTINUED CAPACITY BUILDING THROUGH WEBINARS

Rang-ay Bank officers and staff continue to attend trainings and seminars via webinars for continued capacity building during the pandemic.

The RBAP conducted a Strengthening Internal Controls in Rural Bank Webinar attended by Audit Associate May Ducusin last July 3, 2020 .On July 9, 2020, another webinar in the Digital Marketing conducted by Sales Marketing Expert and Trainer Chris Randolph from Ariva Academy was attended by Marketing Officer Florence Joy Licudine together with Marketing Associate Joy Paatan. The Rural Bankers Research and Development Foundation, Inc. (RBRDFI) also conducted a virtual seminar on How to Spot Fake Documents, Verify Signature, Detect and Prevent Forgery on July 15, 2020 participated by Main Branch Deposit Assistant for COCI (Cash and Other Cash Items) Erika Llanes.

On July 23,2020, Senior Manager for Cash and Remittance Management Eleanor Gozum attended the Market Interest Risk Management facilitated by Dreams Management & Financial Consulting Services . On the same day, VP Nina Francisca Palabay and CMU Associate Shiela May Teodoro took a part in a Transunion Webinar titled “Get to know your borrowers better”. Last August 13, 2020, Perahub also conducted online briefing/training as part of the comprehensive preparation for the new remittance services attended by Senior Manager for Cash & Remittance Management Eleanor Gozum, Treasury Associates, Main Branch Assistant Manager Flor Valencia, HR Training Officer Alexander Ferrer & HR Training Associate Meliza Acosta and Deposit & Loan Assistants from the 29 branches of the bank.

As we all learn to live in the new normal, the bank continues to upgrade the skills and knowledge of its employees through webinars to ensure quality banking services in the countryside.

WE HEAL AS ONE

With the Covid-19 pandemic inflicting damage worldwide to people’s health and finances, banks are one of the few businesses considered essential to keeping economies lubricated. Besides playing a critical role for their clients, banks help to stabilize systems of lending, payments, trade and liquidity.

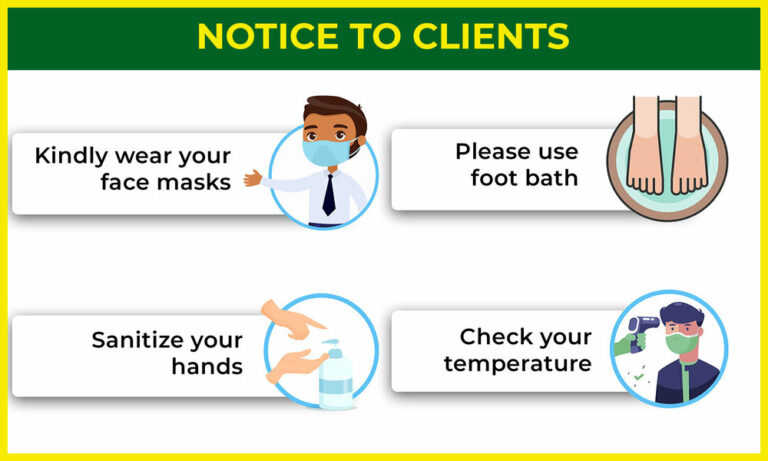

All throughout the pandemic, Rang-ay Bank remained open & continued to serve the people of the countryside by providing essential banking services to the community during the entire quarantine period of ECQ, MECQ & GCQ. To ensure the safety of the employees as well as clients, the bank implemented precautionary health measures when entering the bank premises such as wearing a mask, practicing social distancing, checking of temperature, disinfecting hands and feet and frequent disinfection of the bank premises. The bank also installed acrylic shield for the safety of both bankers and clients.

Working together, we are optimistic that as we diligently follow the health protocols being implemented, we shall overcome this pandemic. In the meantime, we still need to remain cautious and follow all Covid-19 precautions not only inside the bank but outside as well.

2020 STOCKHOLDERS MEETING

Rang-ay Bank held its Annual Stockholders’ Meeting via Teleconference last 21 June 2020. The annual meeting of the bank’s shareholders is conducted to report the company’s business operations for fiscal year of 2019 and to elect the Board of Directors. This is the first time in the bank’s 64 years that the annual meeting was conducted via teleconference.

In his 2019 Annual Report, Chairman Ives Nisce presented the bank’s highlights. In line with the bank’s Mission to hasten progress in the community, the chairman once again announced that the bank continues to meet its lending targets to Agricultural and Agrarian beneficiary borrowers. For the 2019, the total loans extended to the Agricultural sector was 38% of its available loanable funds, more than the required 25% set by law. This has led to the bank to be once again being accredited by the Bangko Sentral ng Pilipinas as a Rural Financial Institution. Likewise, the bank continues to support local business by lending to micro, Small and Medium enterprises including Agri-businesses all over Region I and CAR. The bank again exceeds the minimum lending requirements set by the Magna Carta for mSMES which is 10%. The Chairman also reported the continued growth in deposits as people of the region continue to put their trust in Rang-ay.

Other highlights for 2019 were the migration to Nextbank Software, a cloud-based banking system provided by NXTBK, Inc.; deployment of Automated Teller Machines (ATMs) and the renewal of the bank’s partnership with the Development Bank of the Philippines (DBP) and Landbank of the Philippines (LBP). The bank has been a partner of LBP for twenty-five (25) years. The bank also expanded its Head Office premises with the purchase of the building’s entire 4th floor and relocated its Rosales (Pangasinan) Branch to Gen. Luna St., Brgy Zone III, Rosales, Pangasinan. All of these, as it continued to support local schools, senior citizen associations, farmers groups, and business organizations through community projects.

Chairman Nisce acknowledged the bank’s officers and staff for their hard work and dedication to maintain its status as the biggest bank in its class in the Ilocos and Cordillera Regions with a wide network of twenty nine (29) banking offices. He also thanked the local communities it serves for their continued trust and support of their local bank. He reiterated the bank’s Vision & Mission to empower North Luzon with globally competitive banking services and to hasten progress in the communities of the Ilocos Region and the Cordillera through accessible and affordable banking services. “Asenso mo, Tagumpay ng Rang-ay”.